CGIB - Chartered Global Investment Banker Level 1 (Online)

Powering Global Capital Markets Leadership

A comprehensive program designed for aspiring investment bankers to master the global financial ecosystem. This course blends advanced financial theory with real-world deal-making, capital markets, and M&A strategies, preparing you for high-impact roles across global investment banks and financial institutions.

- (0 Reviews)

Course Features

Certificate with Global Recognition

Access to Bloomberg & Market Terminals

Global Investment Banking Curriculum

Placement Assistance and Networking Support

Expert Faculty from Industry & Academia

Real-world Case Studies and Simulations

Overview

Begin Your Chartered Global Investment Banker Journey with Vantage

Learning Outcomes

Syllabus

Module 1:

Global Investment Banking Landscape & Capital Markets

Module 2:

Financial Instruments & Asset Classes: Equity, Debt, FX, Commodities & Alternatives

Module 3:

Business Economics & EIC Framework (Economy–Industry–Company Analysis)

Module 4:

Accounting for Bankers: Financial Reporting & Statement Analysis

Module 5:

Corporate Finance & Valuation Fundamentals

Module 6:

The Investor’s Compass – Risk, Returns & Market Misconduct

Module 7:

Credit Analysis & Ratings: Principles, Methodologies & Applications

Module 8:

Sources of Capital & Investor Classes: From Angels to Hedge Funds

Module 9:

Deal Structuring & Transaction Documentation: IPOs, M&A, LBOs & Beyond

Module 10:

Ethics, Regulations & Business Law in Investment Banking

Module 1:

Corporate Finance & Financial Modelling Mastery

Module 2:

Strategic Valuation Frameworks

Module 3:

Mergers & Acquisitions Strategy

Module 4:

Leveraged Buyouts & Advanced Deal Structuring

Module 5:

Corporate Restructuring & Turnaround Strategies

Module 6:

Private Equity, Venture Capital & Alternatives

Module 7:

Debt Capital Markets & Fixed Income Leadership

Module 8:

Equity Capital Markets – IPOs & Public Offerings

Module 9:

Strategic Placements & Advanced Equity Structures

Module 10:

Governance, Ethics & Risk in Investment Banking

Module 1:

Strategic Credit Risk, NPAs & Asset Quality Leadership

Module 2:

Insolvency, Distressed Assets, Bankruptcy & Resolution Frameworks

Module 3:

Global Investment Banking Laws & Cross-Border Compliance

Module 4:

Deal Documentation, Contract Law & Transaction Structuring

Module 5:

Corporate, Securities & Regulatory Law for Investment Bankers

Module 6:

REITs, InvITs & Infrastructure Investment Banking

Module 7:

Global & Indian Taxation in Investment Banking

Module 8:

Global Insolvency Innovation & Reform Trends

Module 9:

Ethics, Governance & Fiduciary Integrity in Investment Banking

Module 10:

Global Financial Leadership, Risk & Compliance Excellence

Who Can Enroll?

- Any Graduates from Arts, Commerce or Science

- Candidate from any Professional Qualification

- NISM / Series licenses (in India) or FINRA licenses (in the U.S.)

The candidates who have cleared CA, CS, CMW, CMA (USA), CFA and any other qualifications from time to time.

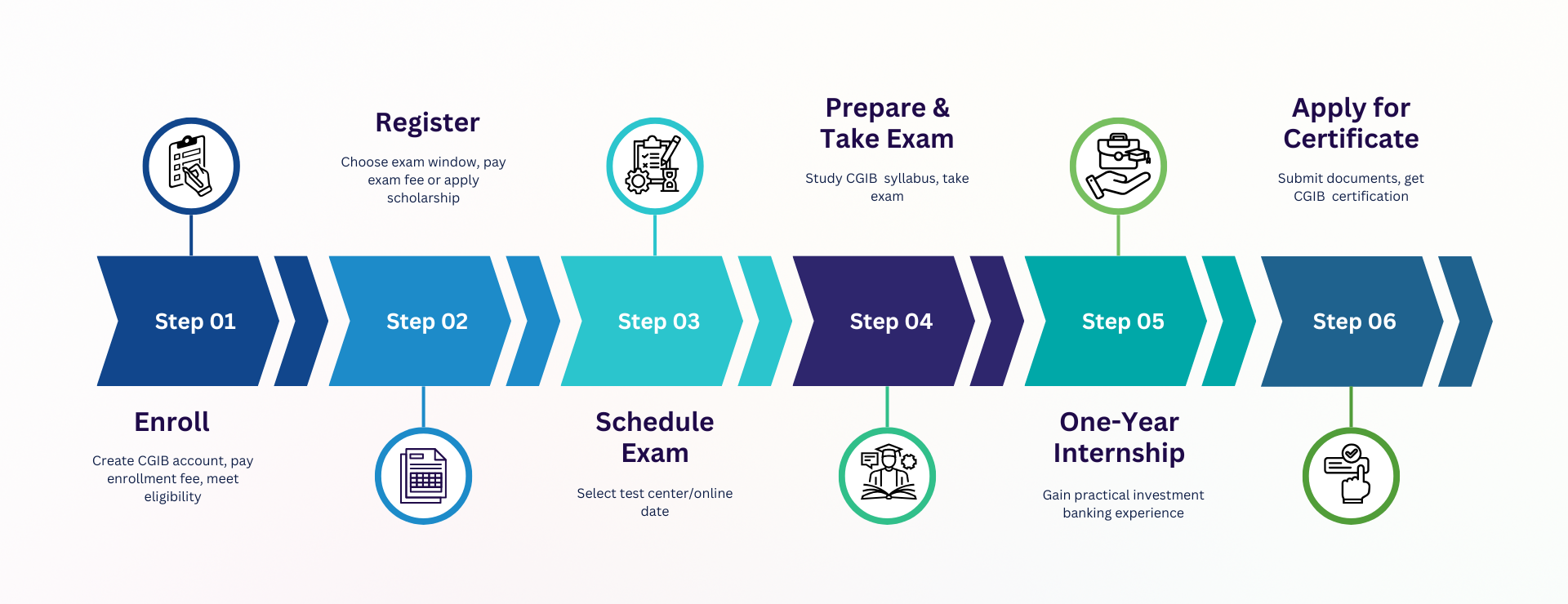

CGIB Roadmap at Vantage Knowledge Academy