Limited Insolvency Examination

Master Insolvency Laws. Restructure the Future.

A practical course designed to give you in-depth knowledge of the Insolvency and Bankruptcy Code (IBC), liquidation processes, and legal frameworks. Learn through real case studies, expert-led sessions, and get career-ready for roles in insolvency practice, legal consulting, and financial restructuring — all backed by Vantage’s industry-focused approach.

- (0 Reviews)

Course Features

Case Study Based Learning

Designed by Industry Experts

Digital Learning Support

Exam & Career Preparation

Regulatory & Legal Focus

Insolvency Laws in Practice

Overview

|

The Companies Act,2013

|

|

IBBI Rules

|

|

IBBI Regulations

|

|

The Companies Act,2013

|

mb |

|

IBBI Rules

|

mb |

|

IBBI Regulations

|

mb |

|

Decisions Awarded by SC, HC and NCLAT

|

min |

|

The Indian Partnership Act, 1932

|

mb |

|

The Limited Liability Partnership Act,2008

|

mb |

|

The Indian Contract Act, 1872

|

mb |

|

The Negotiable Instrument Act,1881

|

mb |

|

The Sale of Goods Act, 1930

|

mb |

|

The Transfer of Property Act, 1882

|

mb |

|

The Code of Civil Procedure, 1908

|

mb |

|

The Limitation Act, 1963

|

mb |

|

The Prevention of Corruption Act, 1988

|

mb |

|

The Prevention of Money -Laundering Act, 2002

|

mb |

|

The Recovery of Debt and bankruptcy Act, 1993

|

mb |

|

The Arbitration and Conciliation Act, 1996

|

mb |

|

SARFAESI

|

mb |

|

MSMED

|

mb |

|

The Real Estate Act, 2016

|

mb |

|

Securities Contracts Act, 1956

|

mb |

|

SEBI Regulation,2018

|

mb |

|

SEBI Regulation,2021

|

mb |

|

SEBI Regulation,2011

|

mb |

|

SEBI Regulation,2015

|

mb |

|

The Employee Provident funds and Miscellaneous Provisions Act, 1952

|

mb |

|

Corporate Finance and Liquidity Management

|

mb |

|

Financial Analysis

|

mb |

|

Tax Planning

|

mb |

|

Goods and Services Tax Act, 2017

|

mb |

|

Constitution of India

|

mb |

|

Rights of Workmen under Labour Laws

|

mb |

|

Basic Principles of Economics

|

mb |

|

Financial Markets

|

mb |

|

Basic Principles of Valuation

|

mb |

|

Forensic Audit

|

mb |

Begin Your Limited Insolvency Examination Journey with Vantage

Learning Outcomes

Insolvency and Bankruptcy Code (IBC) Framework

Insolvency Resolution Process, Role and Responsibilities of an Insolvency Professional

Corporate Restructuring Techniques

Legal and Financial Documentation

SPractical Application of Insolvency Law

Compliance and Risk Management

Dispute Resolution and Mediation

Financial Institution Roles

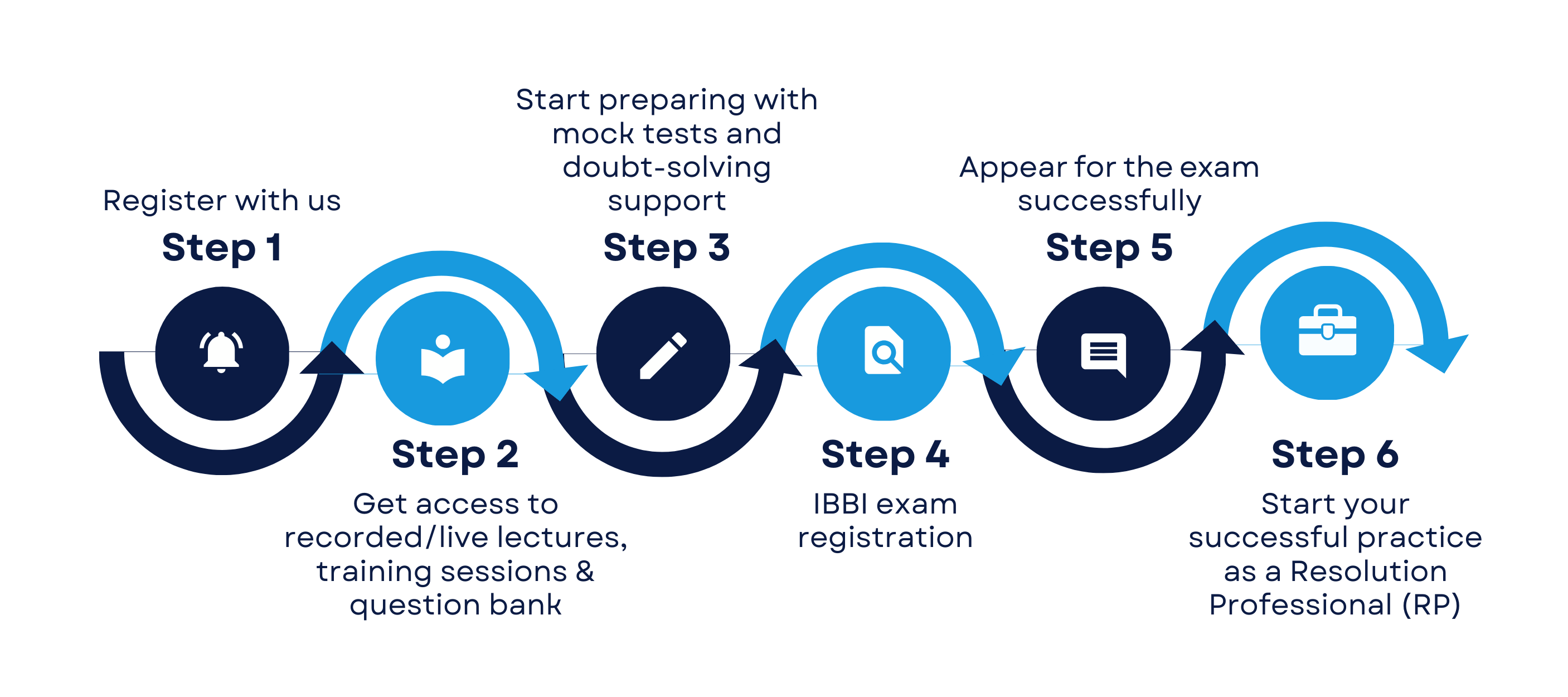

Limited Insolvency Examination Roadmap at Vantage Knowledge Academy

Career Opportunities

Choose The Right Course For You.

FAQs

Who is an insolvency professional (IP)?

What is the Eligibility Criteria for becoming an insolvency professional (IP)?

What parameters are considered for an individual to be fit and proper for registration as an IP ?

Can a non-individual viz. body corporate, partnership firm etc. become an IP?

Is the limited insolvency examination and pre-registration educational course mandatory?

Can, an individual who is not a resident of India, render services as an IP?

Who is an Insolvency Professional Entity (IPE)?