MCOM In Financial Research & Technical Analysis

"Evaluate, Organize Thrive: MCom for Expertise in Financial Research and Technical Analysis"

The M.Com in Financial Research and Technical Analysis is a specialized postgraduate program designed for individuals aspiring to excel in financial markets. It covers Technical analysis, Market research, Trading strategies, and Risk management .It equips students with hands-on experience and industry tools, preparing them for careers in Financial analysis, Trading, and Portfolio management.

- (0 Reviews)

Course Features

No features available for this course.

Syllabus

|

1.1 Indian and Global Financial Economics

|

min | |

|

1.2 Indian and Global Financial System

|

min | |

|

1.3 Regulatory Requirements and Ethics of Financial Markets

|

min | |

|

1.4 Indian and Global Taxation on Investments

|

min |

|

2.1 Quantitative Methods in Finance

|

min | |

|

2.2 Alternative Investments

|

min | |

|

2.3 Behavioral Finance and Investors’ Psychology

|

min | |

|

2.4 Introduction to Global Wealth Management and Financial Research and Technical Analysis

|

min |

|

3.1 Technical Analysis I (Theory, History, Charts, Trends and Patterns)

|

min | |

|

3.2 Chart Development and Analysis

|

min | |

|

3.3 Statistics for the Technical Analyst

|

min | |

|

3.4 Financial Technologies and Algo Trading

|

min |

|

1.1 Indian and Global Financial Economics

|

min | |

|

1.2 Indian and Global Financial System

|

min | |

|

1.3 Regulatory Requirements and Ethics of Financial Markets

|

min | |

|

1.4 Indian and Global Taxation on Investments

|

min |

|

2.1 Quantitative Methods in Finance

|

min | |

|

2.2 Alternative Investments

|

min | |

|

2.3 Behavioral Finance and Investors’ Psychology

|

min | |

|

2.4 Introduction to Global Wealth Management and Financial Research and Technical Analysis

|

min |

|

3.1 Technical Analysis I (Theory, History, Charts, Trends and Patterns)

|

min | |

|

3.2 Chart Development and Analysis

|

min | |

|

3.3 Statistics for the Technical Analyst

|

min | |

|

3.4 Financial Technologies and Algo Trading

|

min |

|

4.1 Technical Analysis II (Markets, Volatility and Risk Management)

|

min | |

|

4.2 Designing and Testing Technical Trading Systems

|

min | |

|

4.3 Theories of Market Dynamics

|

min | |

|

4.4 Project Work

|

min |

|

intro

|

mb |

Begin Your MCOM In Financial Research & Technical Analysis Journey with Vantage

Learning Outcomes

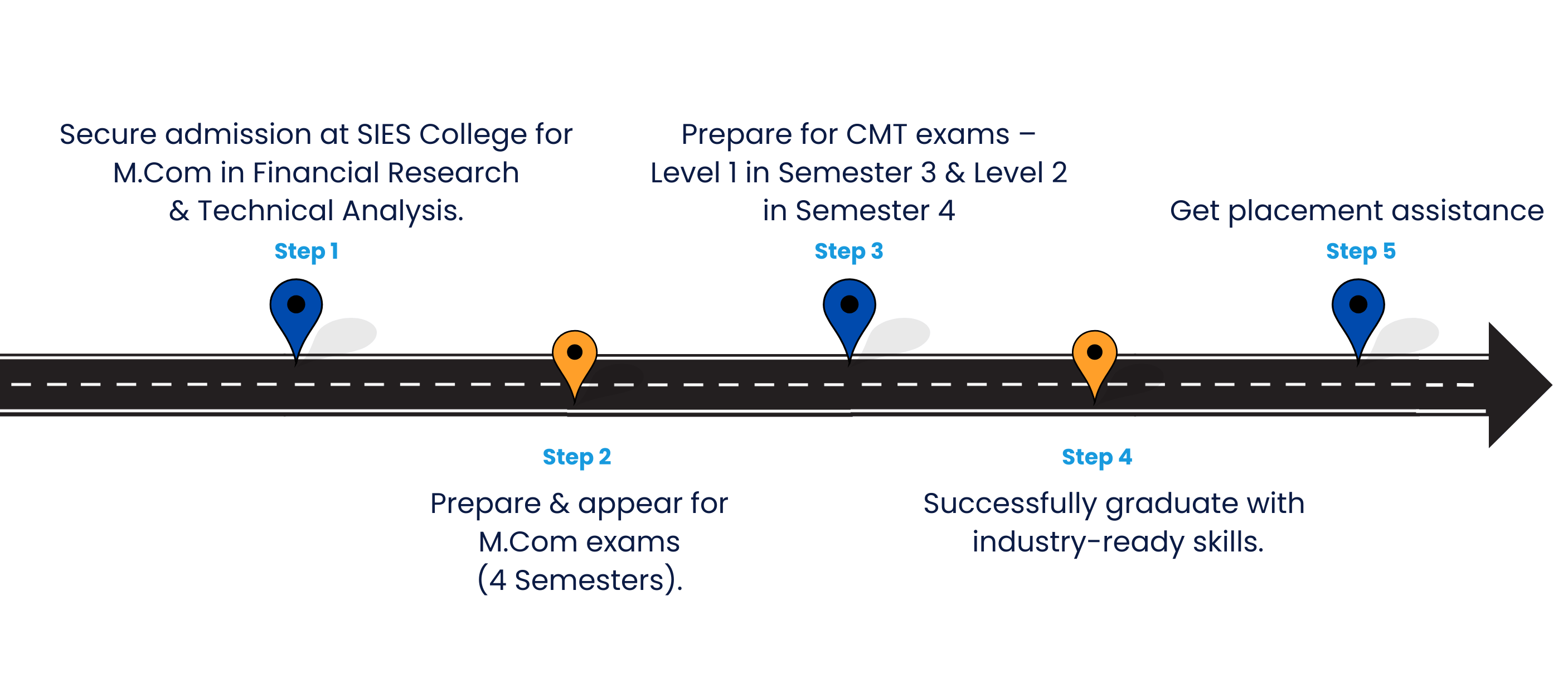

MCOM In Financial Research & Technical Analysis Roadmap at Vantage Knowledge Academy

Our Placements

Career Opportunities

Equity Research Analyst

Evaluates stocks and companies to offer investment advice.

Investment Analyst

Analyzes investment opportunities for portfolio guidance.

Technical Analyst

Uses market data to predict future price trends.

Financial Consultant

Provides advice on managing finances and investments.

Credit Analyst

Assesses credit risk and financial stability.

Risk Analyst

Assesses and mitigates financial risks to minimize losses.